E-INVOICING, ARE YOU READY FOR THIS?

Do you know what eInvoicing is? Have you heard about?

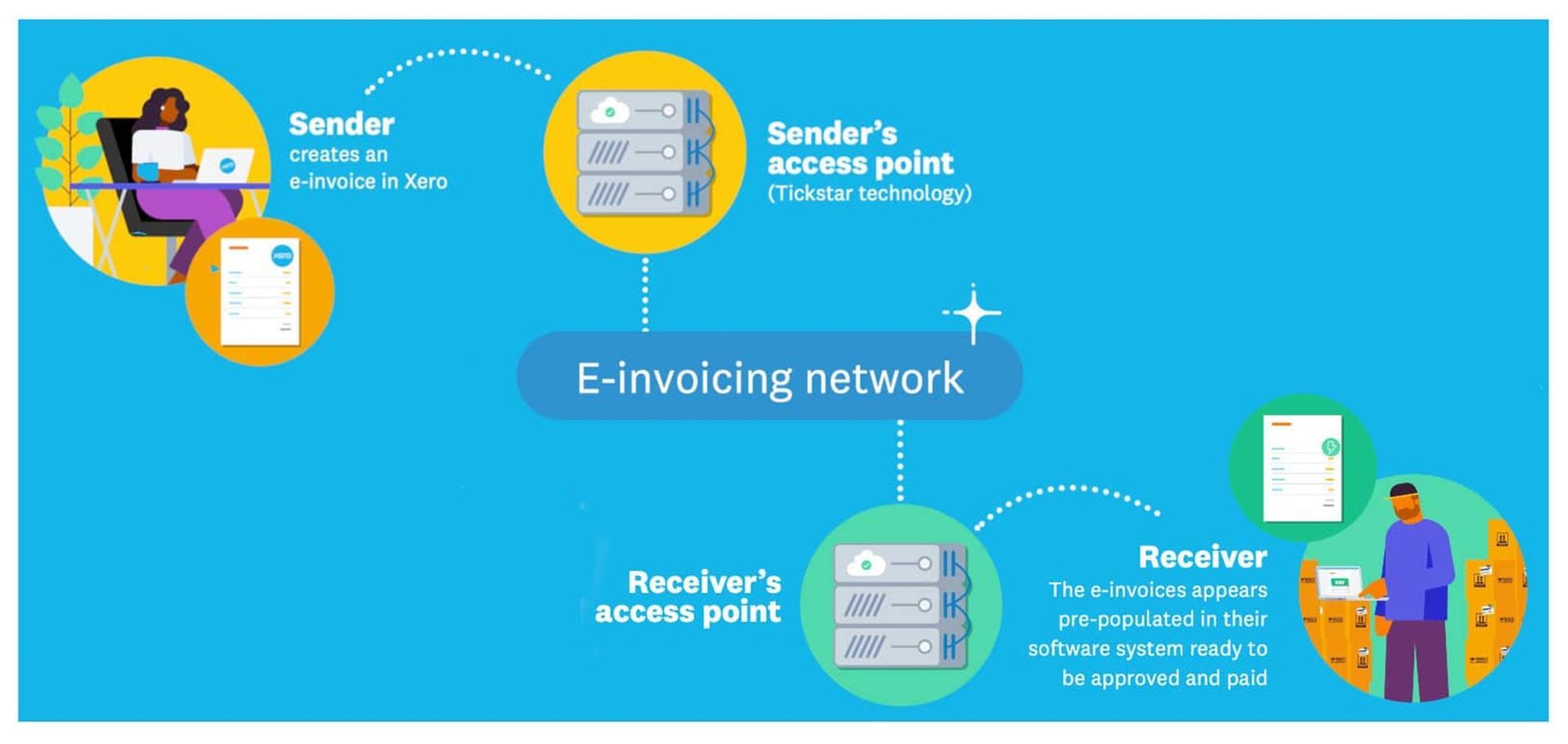

eInvoicing is the digital exchange of invoice information directly between buyers’ and suppliers’ financial systems. The invoice passes through the invoicing network where it validates information like NZ Business number (NZBN). Once the invoice is in the buyer's financial system it is reconciled against purchase details and ready to be paid. The NZBN number is the key to ensure that this invoice reaches the correct destination.

The use of eInvoicing means businesses no longer need to generate paper-based PDF invoices to supply to their customers, and the customer no longer needs to manually load these details into their financial system. eInvoicing improves accuracy, efficiency, security and proven to speed up payments.

Benefits -

- Faster payment and improved cash flow

- Reduced admin

- Reduced processing costs

- Direct and secure information

- Universal connection

- Improved financial visibility

- Available to any business

- Improving our economy

Inland Revenue introduced new laws which took effect 1 April 2023 on minimum records required to support figures in your GST returns, this was to support the move to eInvoicing.

Before long eInvoicing will become the new standard. For most businesses, getting set up only takes a few minutes, for step-by-step guides to get set up, follow the link below.

https://www.einvoicing.govt.nz/einvoicing/what-is-einvoicing

Find out who is registered by following the link below

https://www.einvoicing.govt.nz/peppol