Business Plus One Blog

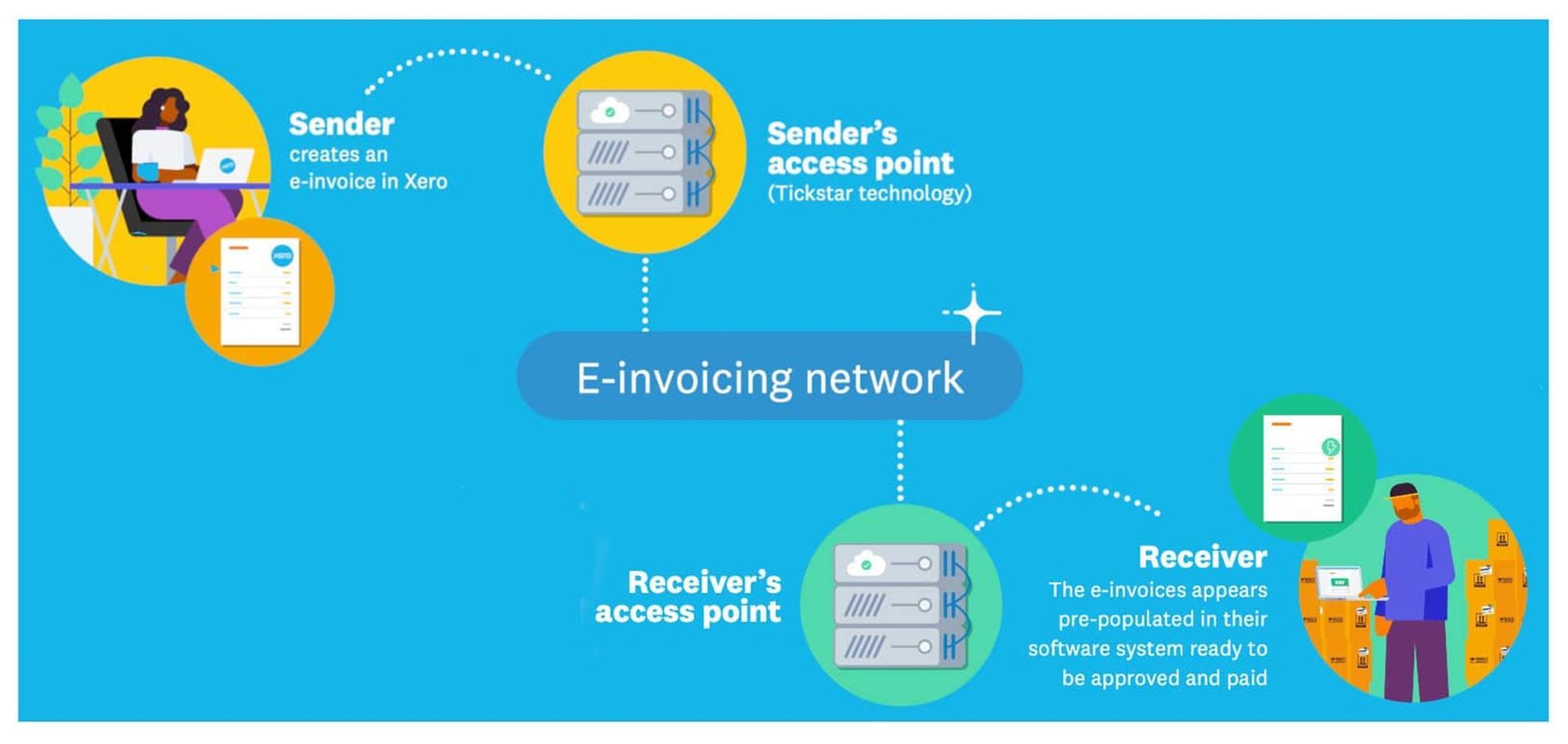

Do you know what eInvoicing is? Have you heard about? eInvoicing is the digital exchange of invoice information directly between buyers’ and suppliers’ financial systems. The invoice passes through the invoicing network where it validates information like NZ Business number (NZBN). Once the invoice is in the buyer's financial system it is reconciled against purchase details and ready to be paid. The NZBN number is the key to ensure that this invoice reaches the correct destination. The use of eInvoicing means businesses no longer need to generate paper-based PDF invoices to supply to their customers, and the customer no longer needs to manually load these details into their financial system. eInvoicing improves accuracy, efficiency, security and proven to speed up payments. Benefits - Faster payment and improved cash flow Reduced admin Reduced processing costs Direct and secure information Universal connection Improved financial visibility Available to any business Improving our economy Inland Revenue introduced new laws which took effect 1 April 2023 on minimum records required to support figures in your GST returns, this was to support the move to eInvoicing. Before long eInvoicing will become the new standard. For most businesses, getting set up only takes a few minutes, for step-by-step guides to get set up, follow the link below. https://www.einvoicing.govt.nz/einvoicing/what-is-einvoicing Find out who is registered by following the link below https://www.einvoicing.govt.nz/peppol

Today marks the beginning of a new financial year!

We understand that the end of the financial year is a busy time. As you gather the information discussed in our previous blogs, please remember to conduct some final checks—such as reconciling your GST with your balance sheet. To avoid any unnecessary late GST adjustments when we review and complete your financial statements, feel free to contact one of our advisors if you'd like us to review your file before you submit your March GST return to the IRD.

If you're back to reading this blog this week, we assume you've reviewed your debtor ledger, stock, and assets as discussed last week. Well done!

Do you use a part of your home for your business, such as a home office, garage, or workshop? If so, you might be eligible to claim a portion of your household expenses to reduce your tax burden. This applies whether you’re self-employed, in a partnership, or run a company.

It’s that time of year again when we need to consider all the important tasks leading up to your balance date and gather the necessary information. In the coming weeks, we will remind you of what needs your attention.

Today, we recommend that you review your debtors’ ledger to assess any bad debts. Consider how old these debts are, what actions have been taken to recover them, and whether they are recoverable. Deciding to write off a bad debt before balance date means you won’t pay tax on an amount you may never recover. If you do write off a debtor as bad and later recover a portion or all of it, the income tax will be addressed in the year you receive the payment.

If you carry stock, have you scheduled your end-of-year stocktake? Remember that March 31st falls on a Monday this year.

When was the last time you reviewed your asset register? Are all the assets still operational? Are there any that are no longer needed?

The three tasks above are just a few of many for the coming weeks. Stay tuned for more updat